Apple’s new ads regarding its sustainability push has created headlines and plenty of online discussion this week. Some applauded the ads as well as the commitment that Apple made towards protecting the planet. Others jeered and mocked, saying that Apple is no longer an innovative company and everything about this initiative is just a good soundbite to please the woke progressive.

Less plastic? Meh. Smaller packages? What is the big deal? Carbon neutral energy sources? Sounds easy!

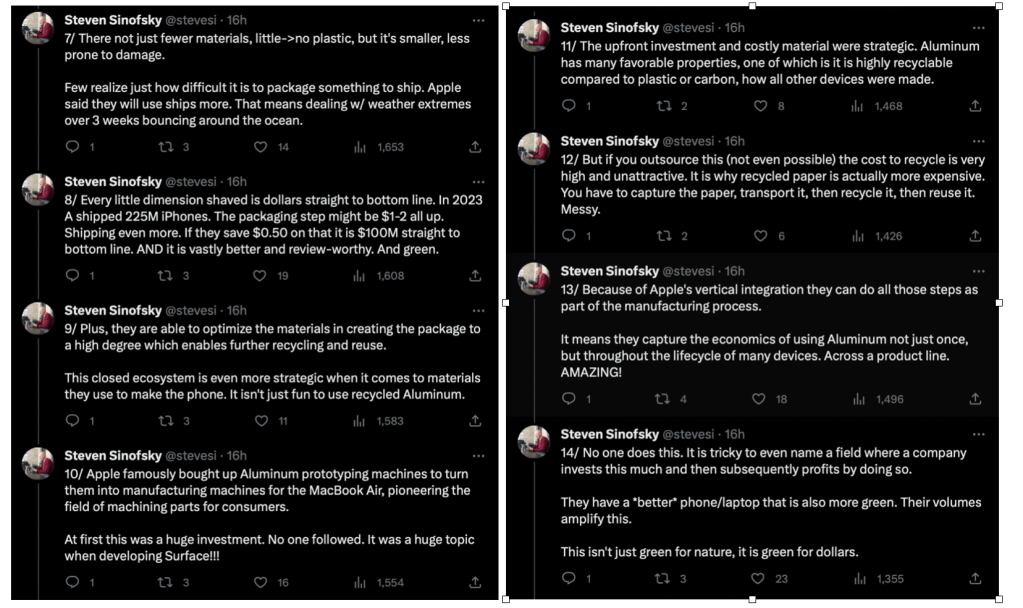

That’s normal in the business world and life. But what I want to get at today is that even things that sound easy and simple at first can require substantial investments and efforts behind the scene. And don’t just take it from me. Here is what former Microsoft executive, Steven Sinofsky, had to say:

And I agree with him. Apple must organize its resources and design internal processes in a certain way to make these changes even possible across a huge organization. Look, I don’t have any experience with industrial packaging. However, I can tell you a few things from my 1st-hand experience in the banking industry.

As a bank, we mail millions of pieces to customers every year. For numerous purposes, including new product offers, paper statements, customer management offers to existing customers or official disclosures. It’s a significant expense line item. At that scale, if we can reduce paper or postage costs by 2 or 3 cents, that will result in a decent saving. It sounds straightforward, but it’s not easy to put in production. Someone will have to do research and make a business case for this initiative. This person will need to coordinate with multiple departments to make sure that there are no blind spots and their business case is as robust as possible. Then, they must get buy-in from leadership and only after being green-lit will they be able to implement their idea. All of this will easily take up half a year, if not more. And if the bureaucracy is bad enough, it may not even see the light of day.

It’s normal for banks to use machine learning to optimize lending. Sophisticated models, if implemented properly, can increase operational efficiency or lower losses. If a credit card issuer can design a predictive model that allows it to underwrite riskier folks (lower FICO) and simultaneously minimize losses, the model then becomes a significant intellectual asset. But to come up with such a score and put it in production is not easy. First and foremost, there must be sufficient know-how to even attempt to build a score. Then, Compliance must approve this score to ensure that it won’t discriminate anyone.

Next step is logistics. Underwriting score usually involves bureau attributes from the likes of Equifax, Experian and TransUnion. Essentially, an issuer will combine several bureau attributes, run an algorithm and spit out a score that can help the issuer decide whether it should target a prospect or not. As a result, the issuer in question must work with a bureau to ensure a smooth process. If a model involves third-party data AND a bureau, then there must be a process to bring such data to the bureau. I can tell you from experience that is process is challenging.

Then, there must be a plan to test the new score against the existing method. Any good test must ensure that all other elements are equal, including offers, seasonality or audience. If a score’s purpose is to minimize credit losses and an offer has 0% APR for 15 months (in reality, we use billing cycles), then any performance data before the promotional period ends is not really indicative of the score’s effect. Like it or not, patience is required here, as nobody can speed up time.

After 18-36 months, the score owner can have a solid evaluation of their work and make necessary adjustments. In the meantime, there are annual tests from regulatory agencies like OCC to make sure there is no discrimination in underwriting practices.

You see, using a predictive model to enhance efficiency in the banking world sounds straightforward and easy. In reality, it is anything but. The same goes in other industries. Unless we have industry or intimate knowledge, we don’t know how difficult it is to implement something, even if it sounds simple on the surface. Even for a company as big as Apple. In fact, I’d argue that the bigger an organization, the harder it is to implement something. Bureaucracy, many departments to coordinate, different priorities, you name it.

Leave a comment