Here are the headline numbers from Apple Q4 FY2024 earnings

| Actual Results (in $ mil) | YoY Growth | |

| Revenue | 94,930 | 6% |

| iPhone Revenue | 46,222 | 6% |

| Mac Revenue | 7,744 | 2% |

| iPad Revenue | 6,954 | 8% |

| Wearables Revenue | 9,042 | -3% |

| Services Revenue | 24,972 | 12% |

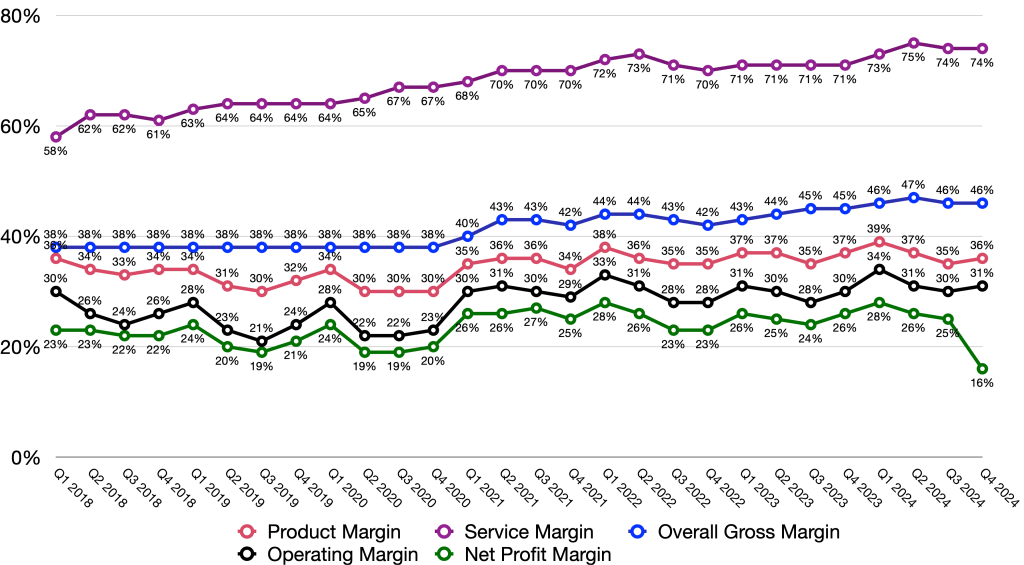

| Gross Margin | 46.2% | 100 basis points |

| Operating Margin | 31% | 110 basis points |

For the past three years, Apple’s growth has been mostly in the single digits. The pandemic pulling forward some growth contributed to that phenomenon. The biggest reason, though, is that it is hard to post jaw-dropping growth on a run rate of $400 billion. For good measure, consumers hold on to their devices more than usual. Hence, when consumer behavior prolongs an update cycle, it is better to lean on it and make money another way than to change it. It is exceedingly hard to change consumer behavior. In this sense, I credit Apple’s management team for recognizing this early, designing an appropriate strategy and executing well in the past few years. If anything, Apple bulls should be happy that Services continues to grow in double digits, even though Products slowed.

Managing a company the size of Apple is not easy. Would you prefer Apple going crazy on expenses to churn out new features to chase growth while sacrificing the quality and the brand name of Apple? Or would you prefer it maintaining the core business while taking calculated bets? Personally, I’d choose the latter every day of the week. Apple took bets on its silicon chip, Vision Pro, Apple Watch, Airpods, the reported failed self-driving car and who knows what else. Some paid off handsomely, some are still in early phases while others were put on the shelf. It’s all about whether you trust that the management team can bring the next big thing. In Tim Cook, I do trust.

While other tech companies hired and fired people en masse during and post Covid, Apple did not. While others reported massive capital expenditure on AI infrastructure, Apple has been deliberate with its investments and how it integrates a hyped tech into its products. And look at the margins. They are slowly and steadily creeping up. The drop in Net Margin this quarter was due to a one-time charge of $10.2 billion in tax payments to the EU. Without the charge, it would be 26%. Plus, Apple Watch & Airpods are very popular around the world. You see them everywhere. The M-chip Macbooks have been an outstanding success. I ask you: if that’s not convincing you to trust in Tim Cook, what will?

Questions

These are my main questions related to Apple that I’d love some answers to. Apple won’t volunteer any of it and analysts on the earnings calls tend to focus on the trendy topic at the time. It was India for a couple of calls and this week, it was Apple Intelligence.

- Google was found guilty in using payments to the likes of Apple to keep its dominant in search. The payment from Google amounts to more than $20 billion a year and should have astronomical margin. What plan does Apple have in case this payment stops?

- Tim Cook is not getting younger. There have been some high-profile departures from Apple lately. Most of his lieutenants are about his age. What is the succession plan? Whoever will be the next CEO (which I think will be John Ternus) will have big shoes to fill.

- There are a lot of revenue streams wrapped under Services and there is virtually no visibility into them. How much is recurring? How much is transactional? How much do the payments from the likes of Goldman Sachs, Visa and Apple make up of the total Services revenue? When will Apple give more disclosures?

- iPhone revenue is good and the new iOS is reported to have great adoption rate. Will Apple Intelligence spark a supercycle?

- What about India? It was hot for a couple of quarters, but it was not even brought up this quarter.

- Can we get some disclosures on Apple’s commercial business?

Leave a comment