I recently became a Bank of America Platinum Rewards Elite (PRE) cardholder and I have been very pleased with the card. During my research for a new credit card, I noticed that PRE flew under the radar and did not get as much attention as other premium and more popular cards such as Amex Platinum, Chase Reserve, Citi Strata Elite or Capital One Venture X. I am going to provide my experience with PRE to help those those looking for a new card.

Features

Cardholders can earn 2 points for every dollar earned on Travel and Dining as well as 1.5 points per dollar on everything else. There is no limit on how much you can earn. If you have Preferred Rewards status, you can earn additional 25%, 50% or 75% rewards, depending on the level of assets parked in Bank of America or Merrill. In theory, that means 3.5% on Travel and Dining and 2.62% catch-all on everything else. That is not bad at all for a catch-all earn rate. The only card that has a higher earn rate in everything is the Robinhood card.

What can PRE cardholders do with the points? Points can be redeemed for cash back, statement credit or travel through BofA Travel Portal. In fact, there will be a 20% discount on flights redeemed with points through the bank’s portal. It’s a little more versatile than the Robinhood card.

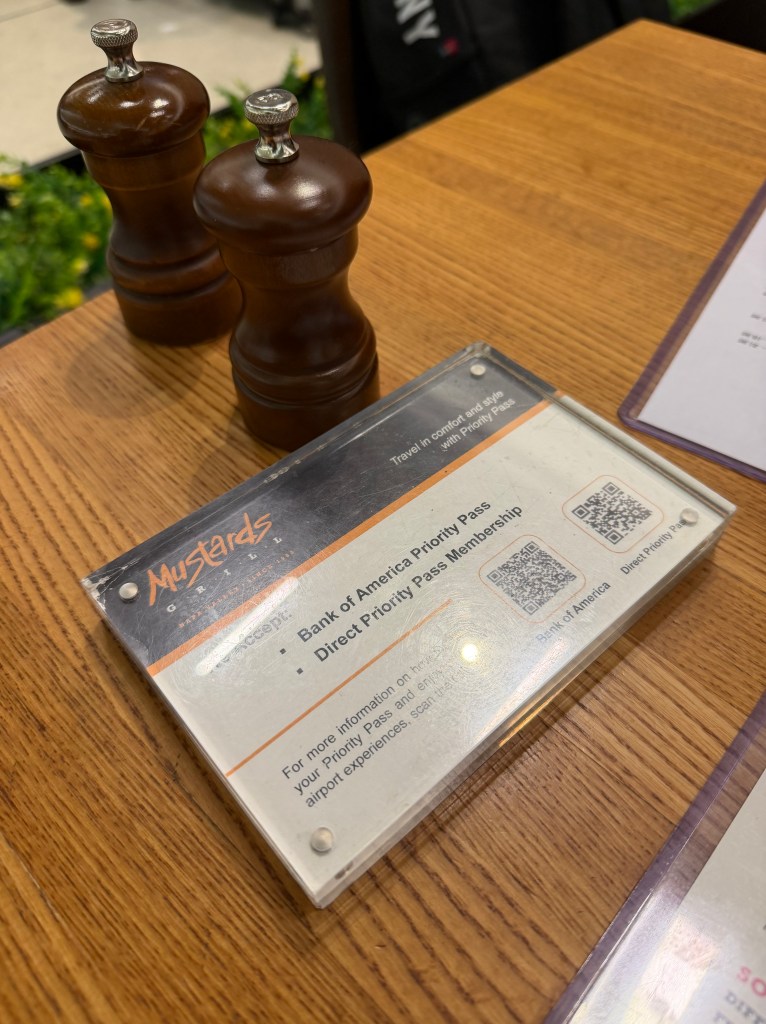

What about Travel benefits? PRE cardholders can get up to 4 Priority Pass memberships. Memberships, not visits. It means that you can gift a Priority Pass account to anyone and you don’t need to make them your Authorized User. It’s a great feature because adding someone as an AU requires knowing their Social Security Number and it’s not a really comfortable thing to ask for. I gifted one to my sister-in-law who doesn’t even live in the US and she used it to access a lounge just fine. There is one feature that is very valuable: Priority Pass Restaurants. You have either $28 off a bill per person or a free set menu, depending on a restaurant’s policy, and you can bring at least one guest (guest policy varies from one restaurant to another, but one is certainly fine). You can hit as many PP Restaurants in a day as you want, as long as not the same one in 24 hours. Imagine how much you can save with a family of four in a trip? Yes, PP is not popular in the US, but it is much better overseas. I recently visited Mustard Bar and Grill at SFO and we paid $6 for two BLTs after the $56 credit. Not too bad. What is great about this is that PRE is pretty much one of a few, if not the only credit card, that gives access to restaurants. All others removed this feature. I do hope that BofA won’t change it any time soon.

Another travel benefit includes Visa Premium benefits. Because PRE is a Visa Infinite card, its holders get benefits when staying at one of the Visa Hotel Collection properties such as late check-out, upgrade when available, $50 USD food and beverage credit, VIP status and complimentary breakfast for two.

As the annual fee is on the higher end ($550), card enthusiasts probably wonder if and how they can earn more than the fee. Well, the good news is that it’s fairly easy with PRE. The card offers $300 in annual airline incidental credit and $150 in annual lifestyle credit. The key here is that annual is based on calendar year. Hence, practically, a customer can earn back $900 in credits in a cardmember year. That’s not too bad, is it? Here are the terms of these credits

Airline Incidental Statement Credit. Qualifying transactions are those purchases made on domestic-originated flights on certain U.S.-domestic airline carriers that include: preferred seating upgrades, ticket change/cancellation fees, checked baggage fees, in-flight entertainment, onboard food and beverage charges, and airport lounge fees affiliated with eligible airline carriers. Airline ticket purchases, mileage point purchases, mileage point transfer fees, gift cards, duty-free purchases, award tickets and fees incurred with airline alliance partners do not qualify. Airline incidental fee transactions must be separate from airline ticket charges. The airlines must submit the ancillary fees under the appropriate merchant category code (MCC), industry code or required service or product identifier to be identified as a qualifying airline incidental fee transaction. Your purchase may not qualify to receive the statement credit if your purchase is processed through a third-party payment account, mobile/wireless card reader, digital wallet not supported by Bank of America or similar technology where the technology does not support transmission of the designated identifiers. Eligible travel expenses that qualify for the Airline Incidental Credit must appear under one of the following Airline MCCs: 3000, 3001, 3058, 3063, 3066, 3132, 3174, 3196 or 3256. Purchases made with the following U.S. domestic airline carriers will not qualify for the Airline Incidental Statement Credit: Allegiant Air, Spirit Airlines, and Sun Country Airlines.

Lifestyle Credit. To qualify, you must use your Premium Rewards Elite credit card to pay all rideshare, food delivery, video streaming service and fitness transactions. Qualifying transactions are those purchases made through select rideshare, food delivery, video streaming service and fitness merchants as determined by us. The merchant must submit the charges under the appropriate merchant category code (MCC), industry code or required service or product identifier to be identified as a qualifying rideshare, food delivery, streaming service or fitness transaction. Your purchase may not qualify to receive the statement credit if your purchase is processed through a third-party payment account, mobile/wireless card reader, digital wallet not supported by Bank of America or similar technology where the technology does not support transmission of the designated identifiers. Eligible rideshare, food delivery, video streaming service and fitness transactions that qualify for the Lifestyle Statement Credit must appear under one of the following MCCs and contain the designated identifier: 4899, 5399, 5411, 5422, 5499, 5691, 5734, 5815, 5816, 5817, 5818, 5921, 5940, 5964, 5968, 5969, 5999, 7032, 7299, 7372, 7841, 7997, and 7999.

After my recent flight booking, I used the card to pay for seat upgrades and received the credit 4 days later. The same went for my transactions with Lyft and Uber Eats. No extra work required. However, I used the card to pay for lounge access three weeks ago and have not received the credit. I called and was assured that the transaction was qualified. The agent even submitted a form for my credit. So hopefully it will come soon. A lot of users on Reddit said that buying credits with an airline was one reliable way to earn this PRE airline incidental credit.

There is also a Global Entry/TSA credit of $120 every 4 years. All in all, I think that PRE cardholders can easily earn back the annual fee.

The standard bonus is 75,000 points after $5,000 spend in the first three months. The transactions eligible for credit still count towards the $5,000 threshold. I think it’s reasonable and doable for many credit card users.

Customer Service & Visa Concierge

I have not been impressed by BofA’s customer service. It took quite some time to talk to an actual human-being. It’s not as bad as Robinhood, but it leaves a lot to desire for. I have Preferred Rewards status and I did expect a better service from the bank, but I was sorely mistaken. I was treated like everyone else and nothing I read on Reddit indicated that was an exception to the rule. It IS the rule.

The Visa Concierge was nice. I submitted a form because I was trying to book multiple rooms for my family. Kiwi Collection reached out and was really helpful. Interestingly, the rates they gave me were a tad lower than what was on Visa Hotel Collection website. Of course, I had no desire to tell them that.

Who is this card for?

PRE is for those who travel a couple of times a year and want to earn rewards on everyday purchases. The top tier airline/hotel cards don’t reward everyday purchases. You’ll gain access to lounge and benefits related to a certain airline, but give up a lot of rewards on grocery, gas or utilities. BofA Premium Rewards Elite has a setup that rewards customers who use the card at many merchants. As explained above, if you reach at least Platinum Honors status in the Preferred Rewards program, the earn rate is very competitive, if not the best, out there. Obviously, noone should ever keep a lot of money in an extremely low-yielding BofA checking/savings account. The good news is that you can unlock Preferred Rewards status by having assets parked at Merrill.

PRE is for cardholders who value flexibility. If you look at the card concept, it screams flexibility. 1.5x catch-all earn rate (2.62x with Platinum Honors and higher) works at all merchants. A lot of Priority Pass lounges don’t often care what airlines you fly with. Priority Pass Restaurants let you have decent food and drinks even when lounges are not available. You can give memberships to even non-AUs. Airline Incidental and Lifestyle Credits don’t require usage of a portal at all. Points can be redeemed for travel, statement credits or cash back. For me personally, the flexibility is a greal appeal in a world where premium credit cards continue to be increasingly limiting and exclusive.

PRE is for travelers who go overseas. If not, Priority Pass is still underwhelming in the US and you’ll be better off with one of the other premium cards.

PRE is for those that can park a certain amount of asset at BofA. The card alone may be appealing enough, but it becomes even better for Preferred Rewards members.

Overall, BofA Premium Rewards Elite has been an amazing product for my needs. My families are in Vietnam so we go back every now and then. We travel domestically once or maximum twice a year. I do want to earn points on daily purchases. I really value the flexibility to choose airlines, not overly beholden to anyone, and still get statement credits.

Leave a comment