Uber released their 2019 Q2 results and earnings today. Below are a few things that are worth noting to me

Take rate

Uber defines take-rate as adjusted net revenue divided by Gross Bookings. Basically it is how much Uber takes out of your trip’s fare. Compared to Q2 2018, all take rates went down

| Q2 2018 | Q2 2019 | |

| Ridesharing Take Rate | 21.86% | 18.99% |

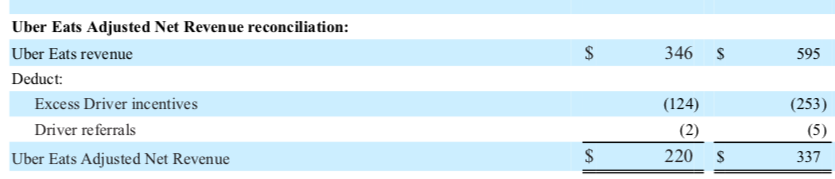

| Uber Eats Take Rate | 12.4% | 9.95% |

| Total Core Platform Take Rate | 20.96% | 17.20% |

Part of the reason for the drop in take-rate is the rise of Excessive Driver Incentives. For instance, Uber Eats’ Excessive Driver Incentive this quarter went to 43% of the revenue, compared to 36% in Q2 2018.

Story of Growth?

It’s no secret that Uber is not profitable and likely won’t be for a while. Their story is one of growth, which is not the case in this quarter as far as I am concerned

| Gross Bookings | Core Platform Gross Bookings | Monthly Active Platform Consumers | |

| Q2 2019 YoY Growth | 29.67% | 30.44% | 30.26% |

| Q2 2018 YoY Growth | 48.64% | 47.92% | 33% |

| Trips | Adjusted Net Revenue | Core Platform Adjusted Net Rev | |

| Q2 2019 YoY Growth | 35.02% | 12% | 7% |

| Q2 2018 YoY Growth | 39.71% | 58% | 54% |

Every metric saw a smaller growth this quarter compared to last year. I do get the laws of big numbers, but when your story is one of growth, this may raise a few concerns.

Among important markets, Latin America saw a 24% decline this quarter despite Buenos Aires becoming the fifth largest city based on trips

Spectacular loss

Uber reported a $5.5 billion loss from Operations. If we take away the stock-based compensation, the loss is still $1.4 billion. While revenue grew by 31%, the operational loss increased by some 89%.

Thoughts

In my opinion, there is nothing in the earnings call from Uber that conveys something remotely close to a clear path to profitability. The story of growth is challenged in this quarter. Perhaps, this is just a bad quarter and the next ones will be better. Or worse. Who knows? Self-driving cars are years and years away, not even 5 years from now. Uber also faces heightened competition in food deliver like Post Mates or Door Dash, companies that attracts big private money as well.

Leave a comment