Traditionally known as an investment bank, Goldman Sachs did not usually count consumers among its clientele. The effort to venture into consumer banking started with its proprietary platform called Marcus. Then, in August 2019, GS launched its first ever credit card, Apple Card, in collaboration with Apple. In 2021, the bank announced that it was going to acquire the General Motors credit card portfolio from Capital One. The acquisition was only completed in February 2022, but it had some effect on Goldman Sachs’ balance sheet a few quarters prior to the completion (more on this later). Along with the GM portfolio, GS also added a platform for home improvement consumer loan originations in GreenSky.

It’s interesting to study the performance of Goldman Sachs’ consumer banking arm for two reasons. First, it will help us understand more how difficult and expensive it is to build and sell consumer banking products from scratch. Second, it is also a proxy of how the Apple Card has been doing, given the notorious secrecy of the Palo-Alto-based tech giant.

Housekeeping facts

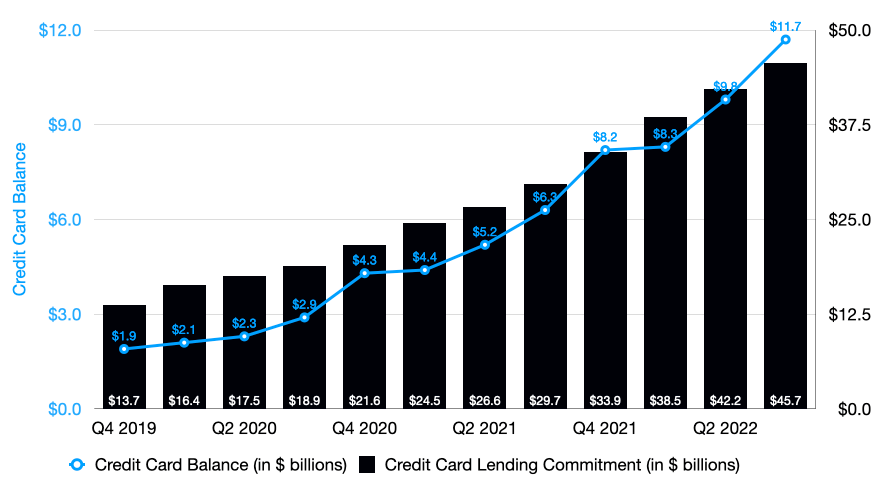

- Between Q3 2019 and Q3 2021, we can be sure that all credit card balance on GS’ balance sheet came from Apple Card. I confirmed it to a member of the bank’s Investor Relations team (see below)

- The GM portfolio and the acquisition of Green Sky were both closed in Q1 2022. It’s safe to say that the bank only included the additional loan balance on its books by then. Said another way, all credit card balance through Q4 2021 was from Apple Card

- Between Q1 2021 and Q4 2021, the bank’s lending commitments included their estimate of the GM portfolio’s balance of $2 billion. The exact language is: “Credit card commitments also includes approximately $2.0 billion relating to the firm’s commitment to acquire a credit card portfolio in connection with its agreement, in January 2021, to form a co-branded credit card relationship with General Motors. This amount represents the portfolio’s outstanding credit card loan balance as of September 2021. However, the final amount will depend on the outstanding balance of credit card loans at the closing of the acquisition, which is expected to occur by the first quarter of 2022.” (Source: Goldman Sachs Q3 2021 10Q)

- The GM portfolio’s estimated balance of $2 billion as of September 2021 was down from the $3 billion figure reported in August 2020

- Between Q1 and Q3 2022, GS credit card lending commitments (another term of the amount of credit lines extended by the bank to credit card customers) included $15 billion in credit lines from the GM portfolio. From Goldman Sachs Q3 2022 filing: “Credit card lines issued by the firm to consumers of $60.66 billion as of September 2022 and $33.97 billion as of December 2021. These credit card lines are cancellable by the firm. The increase in credit card lending commitments from December 2021 to September 2022 reflected approximately $15.0 billion relating to the firm’s acquisition of the General Motors co-branded credit card portfolio in February 2022.”

- Because lending commitments from the GM portfolio didn’t change over the last 9 months, even after the move closed, it’s quite safe to assume that credit card balance stays stagnant at $2 billion, give or take

Apple Card

Using the figures reported by Goldman Sachs and the facts mentioned above, I estimate that as of September 2022, the Apple Card portfolio had $12 billion in balance and $46 billion in credit lines. Those figures were significantly up from $3 billion in balance and $19 billion in commitments as of September 2020. That’s tremendous growth in just 24 months. At $12 billion in outstandings, Apple Card still trails behind the Amazon Prime Card, which is rumored to have $20 billions in comparison. But if Apple and Goldman Sachs can maintain this growth rate, that gap should be closed soon.

Apple and Goldman Sachs give me a $6,000 line on my Apple Card. Assuming that is the average credit line for every Apple Card holder, it would indicate that there are approximately 7.7 million customers in the portfolio ($46 billion divided by $6,000). The figure passed a sniff test to me when news outlets reported the GM book had 3 million customers and there were almost 500 million credit cards in the US. Furthermore, given the popularity of Apple devices in the US, where there are 330 million people in population, the Apple Card portfolio has a lot of room for growth in the future.

In addition, because credit cards are unsecured loans, I’ll be remiss if I don’t talk about delinquency rates of the Apple Card. In Q1 2022, when Goldman Sachs first reported past due loan amount, the 30+ day delinquency rate of the Apple Card was 3.5%. As the issuer tightened its credit policy, coupled with loan deferral programs as well as three rounds of stimulus checks, the delinquency rate dropped to as low as 1.63% before rising back up to 1.9% in Q4 2021. Compared to the 30+ day delinquency rate of Bank of America or Chase, Apple Card’s rate was about 70 or 100 basis points higher as of Q4 2021. While the risk exposure is not as good as it can or should be for GS, remember that the bank has relatively little experience in the credit card industry that has been around for 70-80 years.

Then, the GM portfolio came. The 30+ day delinquency rate of Goldman Sachs’ credit card business shot up to 2.3% in Q1, 2.73% in Q2 and 3.08% in Q3 2022. Keep in mind that this portfolio was previously managed by Capital One. Capital One is more willing to book consumers with FICO less than 670 than its peers. As a consequence, Capital One credit card books tend to have higher delinquency rates. Case in point, the 30+ day delinquency rate of its domestic card was 2.97% as of September 2022. While I don’t doubt that the introduction of GM increased Goldman Sachs’ risk exposure, the tough environment in 2022 might have also caused more Apple Card customers to miss payments.

As a result, I believe that the Apple Card portfolio has higher delinquency rates that what some other issuers reported, and the acquisition of a portfolio from Capital One apparently didn’t help.

New changes at Goldman Sachs

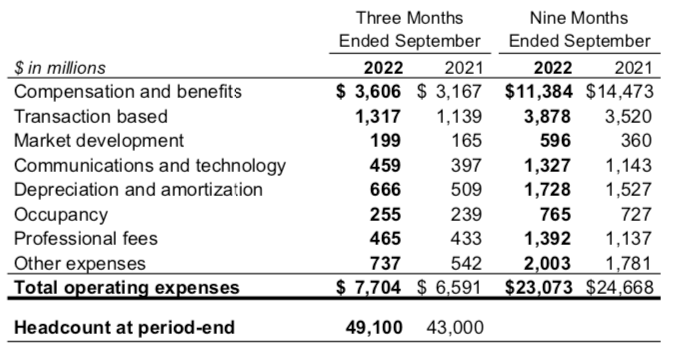

On 1/12/2023, Goldman Sachs announced that they made changes to their business segments and how they would report results to investors. Specifically, the bank will combine Consumer Banking, which includes its credit card division, and Transaction Banking to form what they call Platform Solutions. In the same filing to the SEC, Goldman Sachs disclosed pre-tax earnings/losses of the new segments in the last three years. The Platform Solutions segment lost almost $800 million in 2020, a tad over a billion in $2021 and over $1.2 billion in the first 9 months of 2022. Some news outlets and folks on Twitter were quick to attribute these losses to the Apple Card. So let’s take a look

While we can safely distribute much of the provision to the Apple Card, given the size of the portfolio, Operating Expenses made up most of the losses. This fact and the lack of detailed disclosures make it impossible to know whether the Apple Card really drove such expenses. Remember that Platform Solutions now includes the bank’s digital platform Marcus, Green Sky, the GM portfolio and Transaction Banking. Any of these can have an outsized impact on expenses, especially when the bank invested in infrastructure for future growth. Working at a bank that has retail banking and credit card products, I can tell you that normal consumers don’t know how complex and intensive it is to run and sell these products. Here are a few teams I remember on top of my mind:

- Finance to control the purse

- Compliance to make sure everything is legal

- Credit Risk to help set the underwriting policy

- Operations to make sure everything runs smoothly (and Operations is an umbrella term for several teams like Marketing Engineering, Credit Ops, Rewards, Embossing, Customer Care)

- Customer Management to handle campaigns post-acquisition

- Client Management to take care of projects and communication with our partners

- Acquisition team to run campaigns to book customers

- Data Analytics to help the business leverage data to make decisions

- IT

- Cybersecurity

It’s a giant endeavor to run a Consumer Banking arm. So it’s not really surprising to me that Goldman Sachs is racking up losses at the moment. What I am not convinced of is that the Apple Card is highly unprofitable. Because we don’t have the data to back that up. At least, not yet.

Leave a comment