Growth is hard to come by at the most valuable company in the world, but the firm is not doomed. Not by a long shot.

- Revenue: $81.8 billion, down by 1% on reported currency, up 3% on constant currency basis

- iPhone Revenue: $39.7 billion, down by 2%

- iPad Revenue: $5.8 billion, down by 20%

- Mac Revenue: $6.8 billion down 7%

- Wearables: $8.3 billion up by 2%

- Service Revenue: $21.2 billion, up by 8%

- Gross margin: 45%

- Operating Margin: 28%

- Earnings Per Share (EPS): $1.26

If we set aside the currency exchange factor, even though it’s an important element in a global operation like Apple’s, the company has three consecutive quarters of revenue decline. This is the first time in 8 years that such a long contraction happened. Unsurprisingly, a lot of investors are concerned. For two reasons. The first is that nobody can say for sure if or when this decline will stop, especially as Apple executives already forecast another quarter of negative growth in Q4 FY2023. You can argue that once new products drop, the numbers will pick up. Nonetheless, as consumers are expected to drain excess savings and some companies lay off folks (mine just did this week), it’s really uncertain whether Apple can go back to the growth trajectory. And there are only few things that investors dislike less than uncertainty.

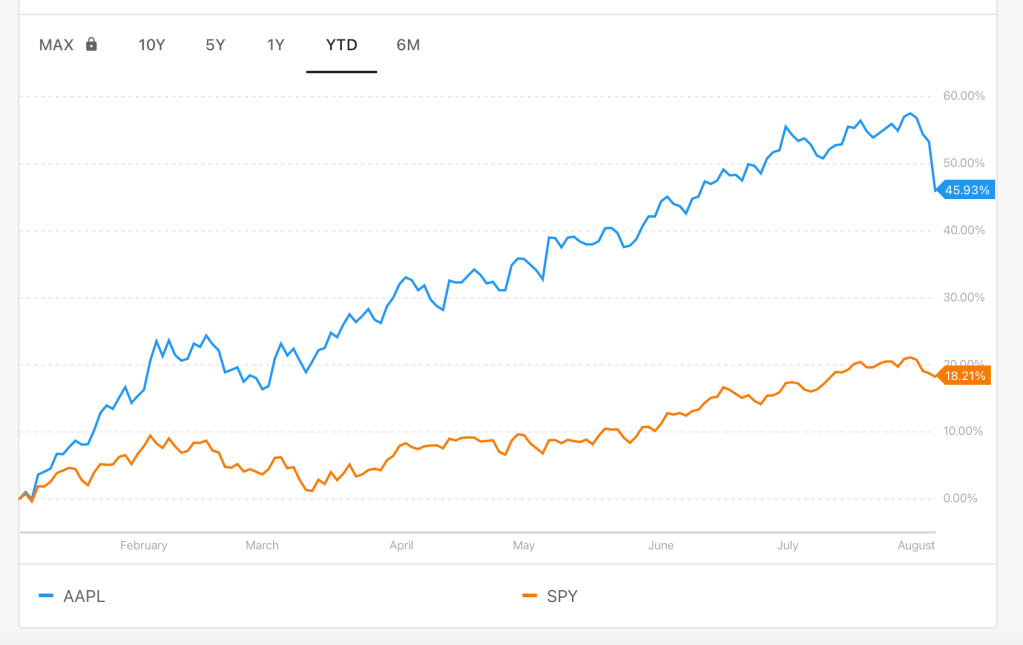

The second cause for concern is valuation. Despite a long decline in revenue growth, the stock is up 46% YTD, notably even after the beating post-earnings, compared to 18% posted by S&P500. Some investors consider Apple too expensive at this level and may sell off to avoid the potential drop.

Such concerns are valid, but I think Apple’s earnings show that there are causes for optimism. Here’s why:

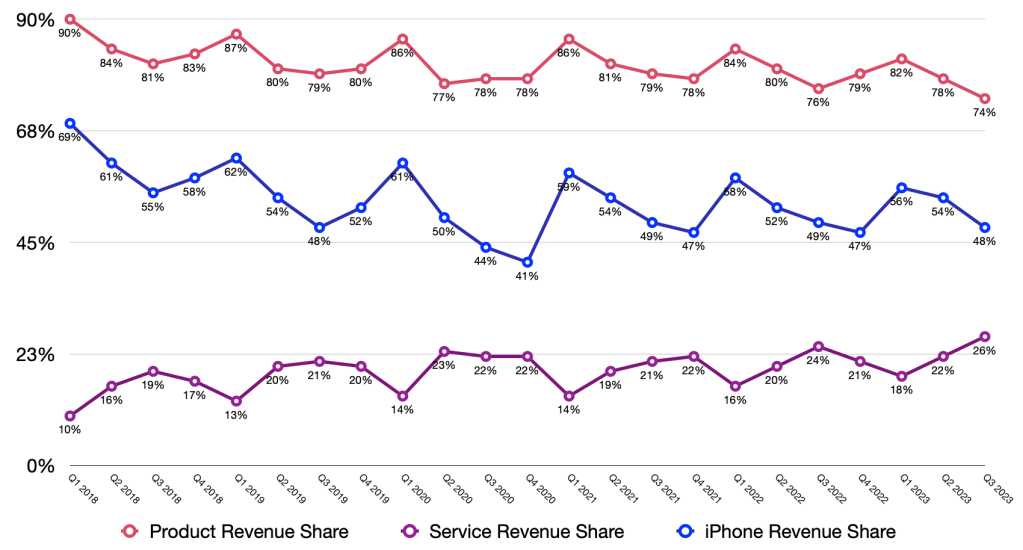

Services revenue share reached a record high of 26% in this quarter, showing higher engagement level and deeper penetration of users in the ecosystem. Apple CFO shared a few more details on the issue:

First, our installed base of over 2 billion active devices continues to grow at a nice pace and establishes a solid foundation for the future expansion of our ecosystem. Second, we see increased customer engagement with our services. Both our transacting accounts and paid accounts grew double digits year-over-year, each reaching a new all-time high. Third, our paid subscriptions showed strong growth. This past quarter, we reached an important milestone and passed 1 billion paid subscriptions across the services on our platform, up 150 million during the last 12 months and nearly double the number of paid subscriptions we had only 3 years ago. And finally, we continue to improve the breadth and the quality of our current services. From 20 new games on Apple Arcade, to brand-new content on Apple TV+, to the launch of our high-yield savings account with Apple Card, our customers are loving these enhanced offerings.

This is one aspect of the business that I think investors need to embrace. Consumers don’t upgrade hardware often any more and it’s exceedingly difficult to change, even for a company like Apple. Rather than butting heads against the wall to solve that challenge, it’s better to keep users in the system, maximize revenue through services and wait till consumers are ready to upgrade. On that end, Apple has been successful so far. Not only do I see no reason for it to change, but in “Thoughts On Apple Subscriptions & Apple One“, I also discussed how the company could elevate Services revenue even more.

The second reason why I don’t panic yet is the competence that Apple leadership shows. Despite a host of external challenges ranging from the pandemic, inflation, supply chain constraints, the war in Ukraine and high interest rates, Apple’s margins are consistent like clockwork. For Q4 FY2023, the company expected the highest gross margin ever. Furthermore, while others hop on one bandwagon after another (think Metaverse, cryptocurrency or AI), Apple leaders keep their feet planted on the ground and simply execute. Such a level-headed, competent and experienced stewardship is a reassuring factor in this time.

In addition, there are levers which Apple can pull to accelerate revenue. New products such as VisionPro or iPhone 15, which is rumored to be the biggest upgrade in the last few years, can provide a boost. Another avenue is advertising. Apple doesn’t break out advertising revenue, but I suspect it’s below $5 billion per year. Amazon notched more than $40 billion in the last 12 months. As you can see, there is a long runway for Apple advertising business to run and it can add 50-100 bps in annual revenue growth. And there is India.

For twelve months ending in June 2013, Apple recorded roughly $24 billion in sales in China. Fast forward 10 years, the figure stood at $73 billion for the twelve months ending in June 2023. That’s a $50 billion increase. If India is where China was 10 years ago and follows the same trajectory, the most populated country alone can add 1.6% growth to Apple’s revenue every year.

At $380-390 billion in annual sales, Apple is not a growth company.I think investors should realistically expect a 3-5% revenue growth per year at best. With that in mind, the levers mentioned above should enable Apple to do just that or at least get out of this slump.

Leave a comment