As the post’s title may already have given it away, yes, I am going to talk about how Uber is in the best shape it has ever been.

From hated and distracted to repaired and focused

It was just 7 years ago when the company had a major PR issue, to the point that the hashtag #deleteUber was trending on Twitter and many users tweeted screenshots of their deleting the app. Scandals after scandals tainted Uber’s reputation and made it vulnerable to Lyft. Morever, even though Uber was already a household name back then, it was stretched too thin across numerous markets, plenty of which were not even profitable.

Fast forward to now, none of these issues exist.

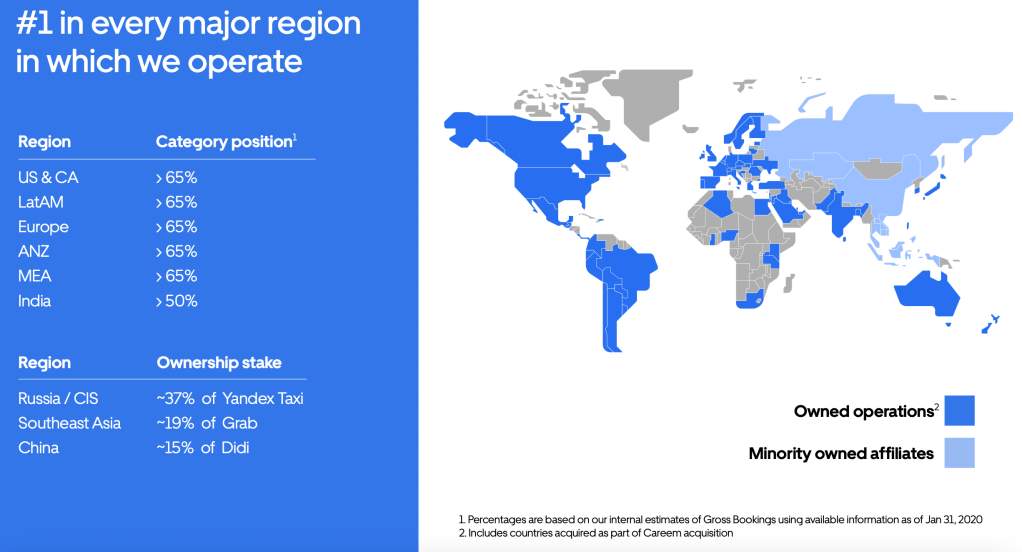

Yes, there are still critics; which is understandable because it happens to every firm, but Uber is no longer hated by thousands of users. The company exited many markets and only operates where it makes financial sense to do so. In other words, if Uber is not already the top 2 player, it has to see a profitable pathway to the top. This is an important factor that leads to the company’s improved financials that I’ll talk about later.

Then Covid

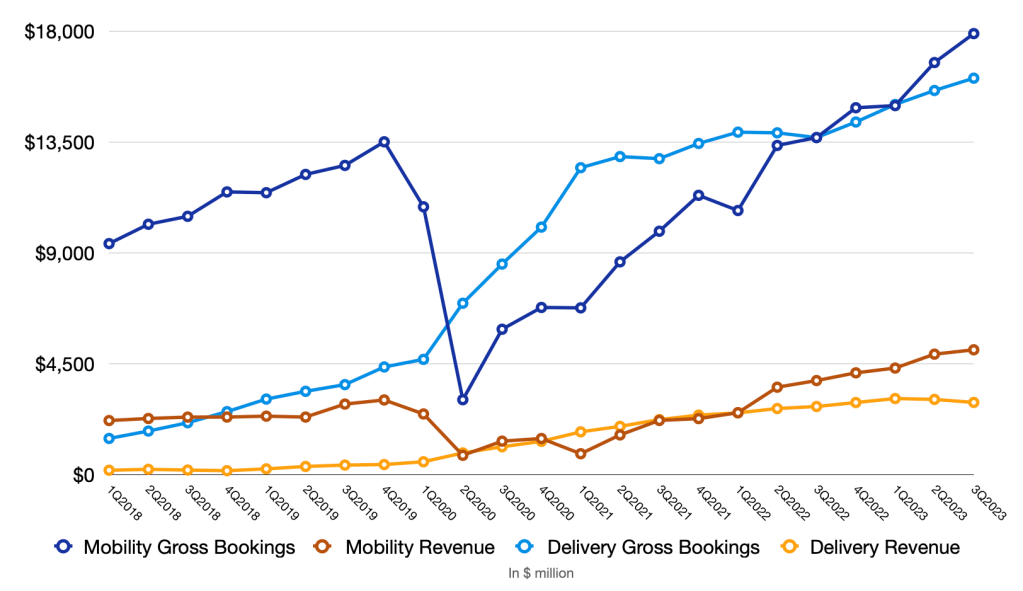

I have already said several times on this blog that Uber is a big beneficiary of the pandemic. Look at the graph below and you’ll see why. Although Mobility was decimated for a while, it is now back up to where it would be otherwise. On the other hand, Covid really turbocharged Delivery and there is no telling that the segment would have been where it is today without the pandemic. But the impact is more than that.

Uber is a three-sided market that involves: consumers, couriers and merchants. One cannot exist without the other two. By growing Delivery substantially during and after Covid, Uber can now help couriers monetize their most precious asset: their time. Drivers can chauffeur people around or delivery food/packages more during a day. Time is less wasted on waiting for the next ride. From Uber’s perspective, because drivers can earn more, the company spends less on incentives; which leads to savings and higher profitability.

The more drivers there are, the better the user experience. Consumers don’t have to wait too long for a ride or a package. Hence, they are more likely to come back to the app whenever they want to go somewhere or have a craving. Uber, again, doesn’t need to offer discounts or promotions to stimulate usage.

Furthermore, the presence of hundreds of drivers and thousands of consumbers makes Uber a compelling platform to merchants. With Uber, merchants can have their goods delivered without retaining drivers on payroll and appeal to hundreds of new users by establishing a presence on the app. The ecosystem’s appeal is so strong that it won over companies that long resisted the temptation. Case in point, Domino’s Pizza, which was a notable absence on Uber’s Delivery app in the past, earlier this year announced a strategic global agreement that will allow Uber users to order from the pizza chain. This partnership, along with many others, is a testament to Uber’s growing platform.

This whole driver-user-merchant dynamic is highly challenging to maintain, but it also presents a strong deterrent to anybody that wants to compete with Uber. How would a newcomer solve the chicken-and-egg problem without Uber’s scale? Just look at Lyft, it used to be a formidable rival, but the gap widened significantly after the pandemic.

Profitable, finally!

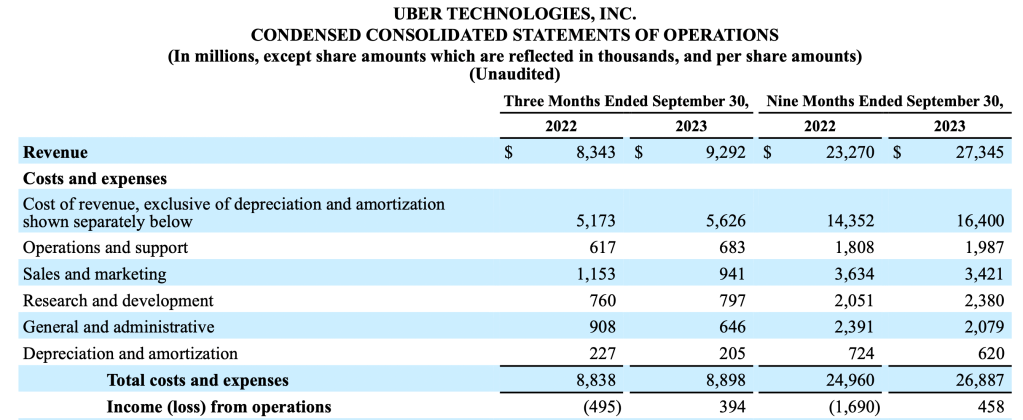

Uber suffered constant ridicule in the past for wasting billions of dollars and being unable to operate profitably. That’s a legitimate criticism, yet now a thing in the past. It’s long overdue, but finally Uber achieved operating profitability in Q3 FY2023 and in nine months so far of this year.

When the company doesn’t have to function in unprofitable markets and the ecosystem is organically growing without expensive incentives, the unit economics will keep improving and eventually lead to positive operating income; which happened this year. Moving forward, I expect higher and higher operating margin as the company continues to optimize its operations and be more efficient. Unevitably, there will be some ups and downs due to strategic investments or unpredictable elements such as legal proceedings or changes in the macro conditions, but the trajectory should be up and up in the future.

Achieving profitability, Uber not only pleases investors, but also puts enormous pressure on other competitors. Ride-hailing or delivery apps no longer have any excuse for being in the red. From here onwards, they must strive to be profitable or explain to investors why they can’t when Uber could.

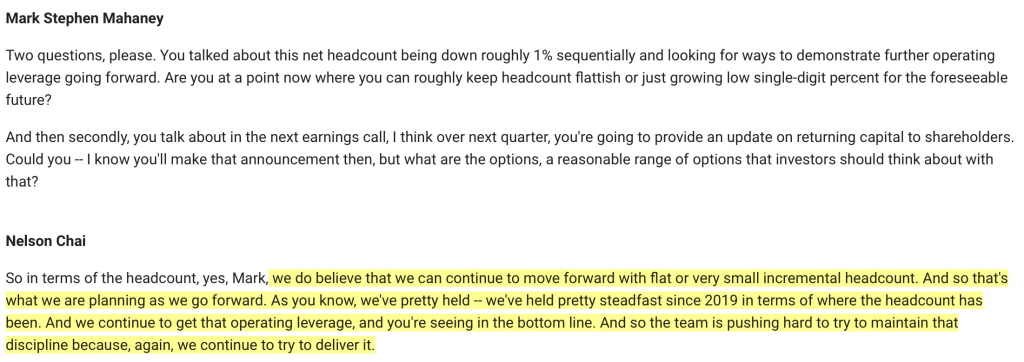

Management deserves credit

Dara and his team deserve a lot of credit for turning the company around, navigating through the historic pandemic and other challenging macro conditions and reaching profitability. They run Uber with great financial discipline. Bookings grew from $65 billion in 2019 to $131 billion in the 12-months ending Sep 30, 2023. In the same period, revenue increased from $13 billion to $35 billion. All the milestones were achieved while the company has been disciplined in hiring. Who doesn’t love to see that?

There is already a new CFO to succeed Nelson Chai, who has done a fabulous job in the last 5 years. It remains to be seen what the new CFO can do, but investors can find solace in the continued leadership of Dara. While I am happy with his stewardship of the company, it’s a palpable risk to investors if one day he decides to retire or take up a CEO gig at another firm. Who knows if Uber can find another CEO as experienced and capable as Dara?

Opportunities & Threats

Personnel, especially at the top like I mentioned above, is the biggest threat to Uber in my opinion. It’s highly challenging to run a complex business like Uber. If the wrong hands are on the wheel, Uber can lose the advantages that it has worked so hard to gain. Regulatory concerns can negatively impact the top and bottom lines, but here are two factors that assuage me:

- Uber has a lot of experience dealing with authorities at local or federal levels

- Because of its scale, Uber can afford any new regulation that makes it more expensive to operate in the industry. Not sure I can say the same about its smaller competitors.

In terms of competition, there are formidable rivals such as Instacart, Lyft and DoorDash. However, there is none at the moment that can topple Uber. Instacart doesn’t have a Mobility segment nor the global footprint that Uber has. DoorDash is strong in deliveries and operational globally, but it doesn’t have Mobility either. Lyft is restricted to only ride-hailing in the US and Canada. Only Uber has a global footprint and two equally strong segments: Mobility and Delivery.

Regarding growth, I don’t look to ads as a game changer. Don’t get me wrong, high-margin ads can boost profitability, but it’s a slipper slope as too many ads can derail user experience. Instead, here are places where I expect to see growth:

- New verticals: New Verticals for Mobility and Delivery reached an annual run-rate of $9 billion and $6 billion respectively. Impressive as they are, those numbers are still small compared to what the segments generate today and leave lot of room for improvement. Delivery New Verticals is especially important to customer retention, in my opinion. Most people don’t take an Uber every day, no matter how much they like the brand. To increase engagement and loyalty, Uber must be a part of high-frequency activities such as grocery shopping, food ordering or package deliveries. The more utility Uber delivers, the more likely consumers will use the app and keep coming back. And Uber won’t get there by offering more discounts to rides that consumers don’t need.

- Uber One: Unsurprisingly, Uber One users spend more and use the app more than non-subscribers. Because there are 15 million Uber One subscribers among 140 million+ monthly active users, Uber has a lot of runway on this front, to sign up more subscribers and grow bookings organically. Furthermore, since Uber One users have higher intention to order from the app (otherwise they wouldn’t subscribe), having more of this valuable group of customers will enable Uber to appeal more to merchants and advertisers, in the same way that Amazon does with its Prime base.

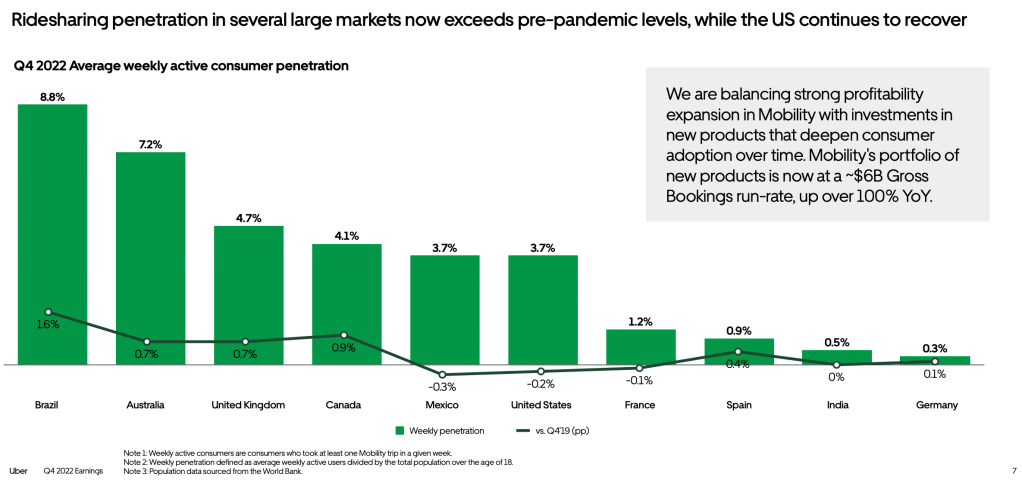

- Higher penetration rate in key markets: India and several key markets in Europe still don’t have the same penetration rate as the US. There is no reason not to take US as the target and try to reach there.

Look, as an Uber shareholder, I may be biased towards the company. But as I have followed it for several years and talked about it on this blog several times, I have never been more bullish about its outlook. Well, at least for the next 2-3 years.

Leave a comment