Save first

“Every month, after paying bills and spending on things that help me enjoy life, I am going to put the rest in my savings”.

Sounds familiar? That’s often what I hear from people. The pitfall of such a tactic is that it prioritizes spending over savings. To make matters worse, we tend to have terrible self-control that, more often than not, leads to over-spending and having little left for savings. So why not reversing the order?

Personally, the first thing I do after a paycheck is to transfer a pre-determined amount to my high-yield savings and investment accounts. Of course, I need to make sure I have enough for bills, some discretionary purchases and emergencies, but a good chunk of my bi-weekly paychecks is preserved. That way, I limit the available amount of funds for discretionary purchases and ensure that my rainy fund grows every 2 weeks. The reversed order puts the priority on the savings, not the spending.

Embrace the limitations

We have a small apartment, without a walk-in pantry or a huge freezer. Admittedly, we sometimes wish we had more space to store more food and ingredients. “We could have bought more cat food or rice and saved money, if we had a bigger pantry” kind of things, you know.

However, most of the time, we embrace the limitations that our small space imposes on us. It makes us think more about what we want to store and avoid over-buying just for our comfort. This and the first tactic share the same principle in that we try not making ourselves too comfortable via self-compelled restraints.

No more Costco

Like others Americans, we used to be frequent buyers at Costco. However, we realized that most of the time, our Costco receipts exceeded $100 and we felt a little bad on the drive home. The problem is that we subconsicously urged ourselves to spend more at Costco whenever we were there to justify the $60 annual fee and the 20-minute drive. For good measure, because Costco sells items in bulk, it is often more than what we need; which leads to over-spending and sometimes food waste.

Hence, we opted for Sam’s Club, Asian Market and Aldi. Asian Market and Aldi have very good produce at smaller quantity. We buy only what we think we can eat in a week so that we won’t have to over-purchase or waste food. For Sam’s Club, it’s much closer to our place and we found a good deal that allowed us to become members for a year at $25. The lower annual fee and, more importantly, the closer proximity take away the urge to justify our travel and membership. Our Sam’s Club membership will expire in August and we’ll look for more deals and see if it’s worth it to continue shopping there.

What we can say is that since we abandoned Costco, our grocery bills and food waste have gone down significantly.

“Spend $1, Save $1”

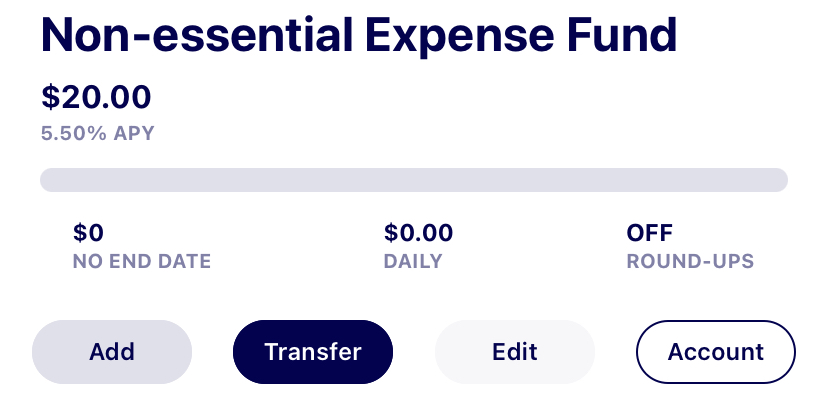

I learned this tactic from the book “Just Keep Buying“. The rule is that whenever we make a discretionary purchase, we have to park the same amount in savings or investment.

For 2024, my wife and I make a pact that whenever we buy something, unless both agree it’s essential and we have to hold each other accountable, we must put the same amount away for savings. When a purchase is considered “non-essential”, the one that pays is required to honor the rule and add to our savings account as penalty.

Last Thursday, after picking up my wife, I noticed she had a long day and probably would prefer not having to cook for dinner. I suggested a pizza restaurant nearby. Following the rule, we transferred the same amount we paid for dinner to our savings account. Was it necessary that we fueled our bodies? Yes. Did we need to go for pizzas? No! We could have cooked at home, but since we splurged on ourselves, we must pay the penalty.

This mechanism makes us think twice about any shopping decision and we feel good about it.

Leverage free sources

In the last 6 months, I borrowed 15 books from the local public library. For free. It saved me easily $100 on books. Plus, we received two free tickets to the Omaha Zoo that were worth $50. By being a library member at no additional cost, I saved our household $150. Not bad, heh?

In every city, I believe there are resources, usually publicly funded, that we can tap into for savings. We just need to look for them.

In short, personal finance tips are…personal. These tactics work for me and my wife, but they may not work for you. All I can hope for is that by sharing these, I can give you a little inspiration to save more and spend less. If not, thanks for reading!

Leave a reply to Weekly Reading – 13th January 2024 – Minh Quang Duong Cancel reply