Uber

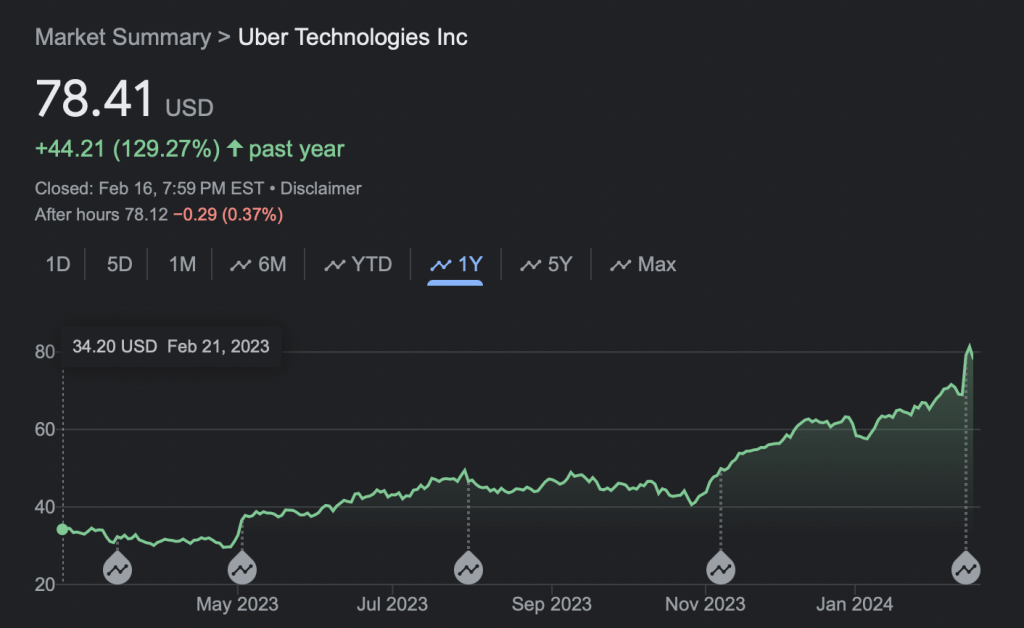

To understand how investors view Uber, look at this stock chart:

Uber’s stock price has increased by 34% in 2024 and doubled in the last year, easily outperforming the S&P500. The price increase duly reflected the state of the business. Uber used to be a one-trick pony as a ride-hailing platform, littered with PR problems and unprofitability. Since the pandemic, it is anything but.

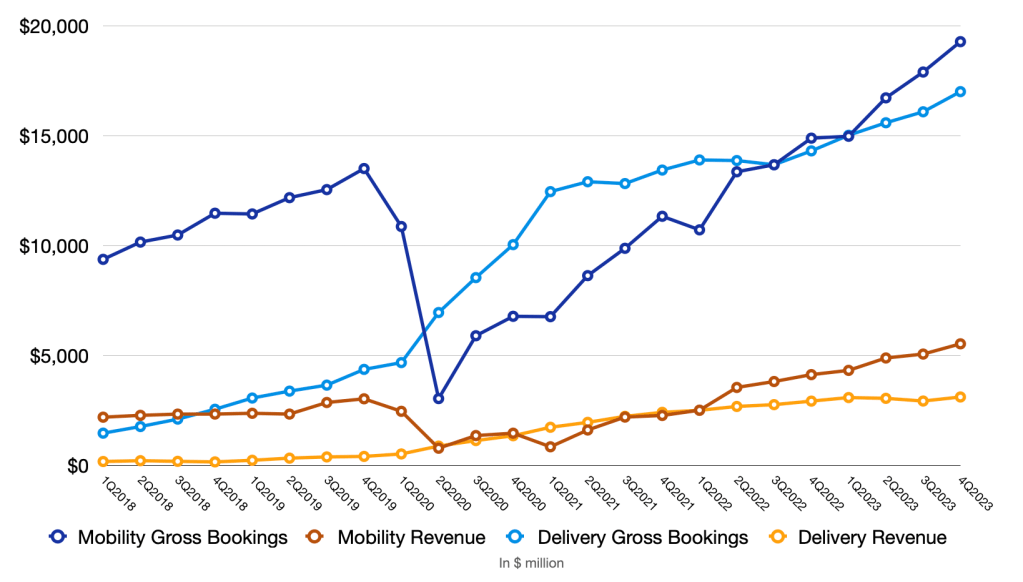

The pandemic destroyed the Mobility segment, but catapulted Delivery. Since we exited Covid, Mobility has been growing relentlessly and gotten back to where it was supposed to be all along. Delivery has slowed down, but even with more moderate growth, it has closed the gap to Mobility significantly, making Uber a two-headed monster.

It’s not just about being bigger. Delivery and Mobility complement each other. Drivers can earn more by chauffeuring passengers around and delivering orders. Customers are more motivated to become Uber One subscribers as they can benefit more from the program with Delivery. Uber One is to Uber what Prime is to Amazon. They make up 50% of US Delivery Bookings, 45% of all Delivery Bookings and 30% of Uber’s total Bookings. These loyal customers are the most active, they don’t incur high acquisition costs and according to Uber, they are profitable after the first year. Look around and you’ll see that there is no competitor that can do what Uber does at that scale. And the barriers to entry in this 3-sided marketplace are prohibitively high.

In addition, Uber is now a GAAP profitable company. The company’s free cash flow is so good that it announced this week the first ever stock buyback of $7 billion. You don’t authorize stock repurchase without a sustainable positive free cash flow now and in the near future. What was once the ridicule of investors as a money-losing machine is now a dominant player with strong business fundamentals. Being profitable also raises the bar for Uber’s competitors. They now have to face questions like this from investors: if Uber can make money, why can’t you? And good luck with making money while scaling a marketplace like this.

PayPal

Contrary to Uber, PayPal seems to be in the world of trouble.

PayPal has three main business segments: branded processing, unbranded processing and peer-to-peer payments (P2P). P2P refers to the transmit of funds between end users through PayPal and Venmo. Except for some convenience fees, PayPal doesn’t make any money from this type of transactions that are important in keeping users engaged and providing the outstanding balance on Venmo or PayPal accounts that can potentially turn into branded processing revenue.

PayPal generates revenue from unbranded processing when they act as a payment processor behind the scenes for the likes of Live Nation, Uber or Booking.com, just to name a few. Working with large-scale merchants solves the volume question, but PayPal has to give up so much margin on every transaction. To my knowledge, PayPal lowered Braintree margin even more lately to starve off competition from Stripe, Adyen and other processors.

Branded processing refers to revenue when payments are processed under the brand PayPal. The PayPal checkout button is more popular among small and medium-sized businesses (SMBs). With this clientele, the volume is not as big as unbranded processing’s, but PayPal earns much higher margins.

For the last two years, investors have been concerned about the declining appeal of PayPal checkout button and the low margin from unbranded processing. The most recent earnings release did nothing to assuage such concerns.

Unbranded processing (PSP) continues to post impressive growth and makes up 35% of the total volume (TPV) while branded checkout slid to 29% of total TPV. This trend and the fact that more large merchants pick up branded processing and manage to negotiate lower fees mean that the margin question remains unresolved.

P2P ex Venmo, as share of total TPV, declined from 10% in 2022 to 8% in 2023, indicating fewer users use PayPal to send and receive funds. If end users don’t like to use PayPal to transfer funds, how will they company convince merchants to adopt the icon ic checkout button and generate outstanding balance on PayPal accounts?

I understand the new CEO has been on the job for just a few months. He has a big job on hands, so maybe he deserves time and the benefit of the doubt. Even after he made bold claims that he hasn’t backed up yet. But there is little that I can see so far that PayPal can do to restore investor confidence.

Leave a reply to Weekly Reading – 24th February 2024 – Minh Quang Duong Cancel reply