Last week, Apple announced the results of its first quarter of FY2025. Here are the numbers:

| Actual | Estimate | |

| Revenue | $124.3 bn | $124.12 bn |

| iPhone Revenue | $69.14 bn | $71.03 bn |

| Mac Revenue | $8.99 bn | $7.96 bn |

| iPad Revenue | $8.09 bn | $7.32 bn |

| Wearables | $11.75 bn | $12.01 bn |

| Services | $26.34 bn | $26.09 |

| Gross Margin | 46.9% | 46.5% |

| EPS | $2.4 | $2.35 |

The company’s revenue growth continues to be slow at 4% YoY. For the past 12 quarters, Apple either had revenue decline or growth in a single digit. No exception. The slight beat in revenue resulted from strong revenue in Mac, iPad and Services. iPhone and Wearables declined by 1% and 2% respectively. Gross margin continues to impress as it arrived at the higher end of Apple’s guide and beat expectations. Let’s go beyond the numbers and talk about some of the major areas regarding Apple’s business.

Hardware & iPhone Revenue

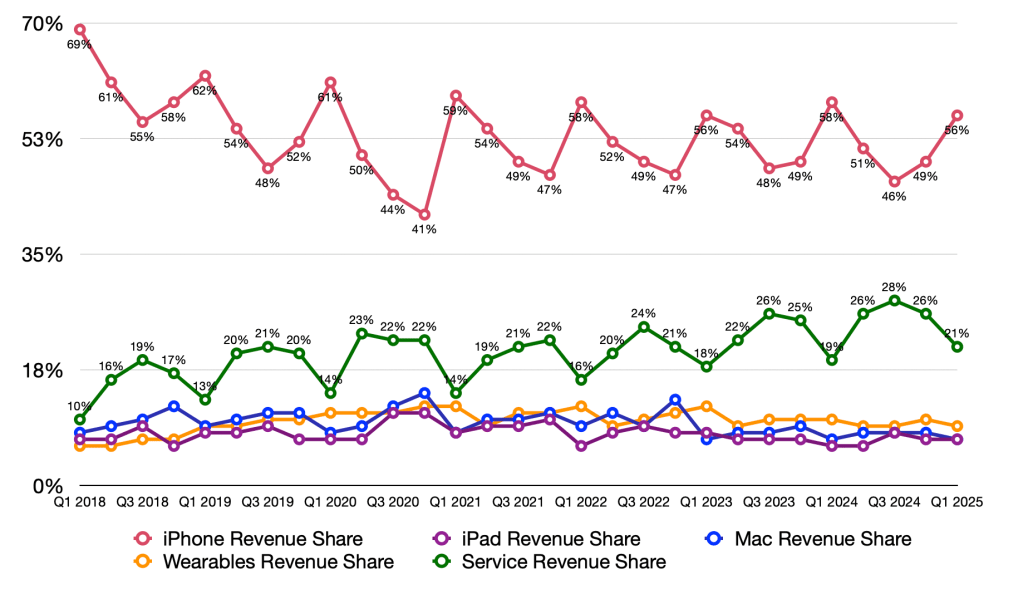

Products made up 79% of the total company’s revenue, the lowest for December quarter since 2018. Meanwhile, Services was responsible for 21% of Apple’s revenue, the all-time high for December quarter. As people hold onto their devices more, I expect to see a gradual decline in Product’s contribution and a gradual increase in Services’.

Apple’s hardware sales is tumultuous as growth is really driven by new launches. This factor, coupled with consumers’ tendency to keep device turnover low, makes it highly challenging to grow significantly. At Apple’s size, it is to the management’s credit that they still posted modest growth in the low single digits. With that being said, it’s hard to get excited about Apple’s growth. Maybe the current management has something up their sleeves to kick the engine up another gear, but analysts and investors have little visibility into what that is. As a result, any criticism over sluggish growth is warranted.

I don’t believe that Apple Intelligence will be a game changer for Apple. I don’t have iPhone 16, so I don’t know what the new feature is like on the phone. But I have not used it even once on my Mac. My experience was the same with or without Apple Intelligence. On the earnings call, Tim Cook talked up the feature and said that markets where they rolled out Apple Intelligence outperformed markets where they didn’t. I don’t have evidence to say that the man lied on a call where he is obligated to be truthful. However, it’s little bit hard to believe when he praised the notification summary feature to the sky. Come on now, Tim.

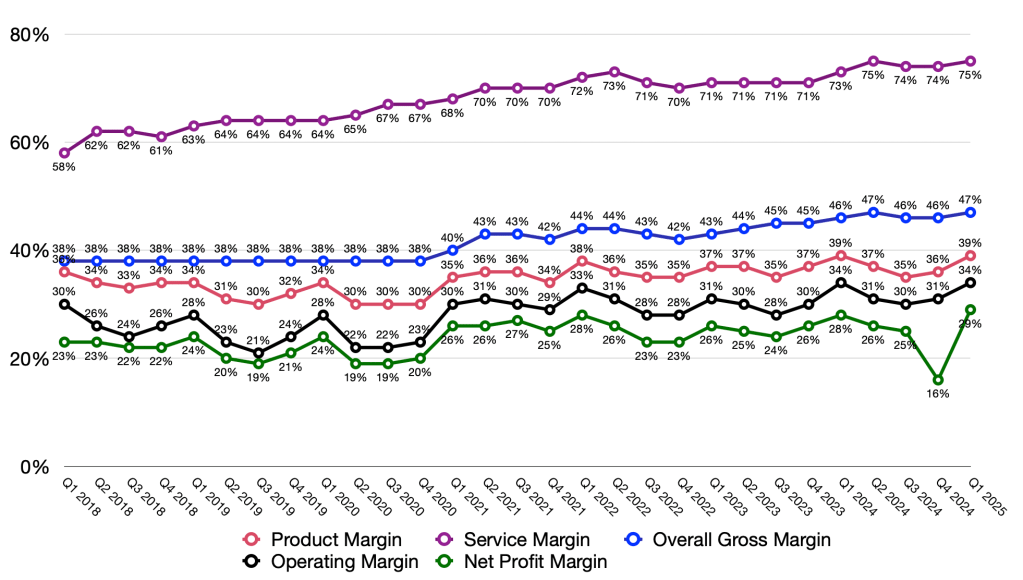

Services

Services is a bright spot for Apple. Not only does it have very high gross margin, but it also speaks volume about the ecosystem that Apple builds. The more Services grows and the bigger the installed base, the tighter the grip Apple has on its users. As long as that condition is still true, Apple will have enormous bargaining power when dealing with prospective partners (ask OpenAI, they receive no money from Apple for its partnership) and the company will still have no shortage of ways to make money. I expect that by 2030, Services will make 30% of the company’s revenue every quarter.

There is, however, a cloud of uncertainty hanging over Services. It is possible, and dare I say, more likely than ever, that the company will lose the lucrative deal with Google. It is believed that Google pays Apple over $20 billion a year to be the default search engine on Apple devices. It makes up a significant share of Apple’s net income. If that deal is prohibited, will Apple be barred from seeking an alternative partner for another deal of the same nature? If not, how will it make up for the lost revenue and pure profit?

For such an important part of the business, it’s unfortunate and even disgraceful that the management team provides little visibility. For instance, how much does Apple make from advertising? How much does it make from payment services? How much does it make from partnerships with Goldman Sachs, Google or Visa? More information and data on such areas will help investors gauge how big Services can grow and how Apple can absorb shocks such as the potential loss of the Google deal.

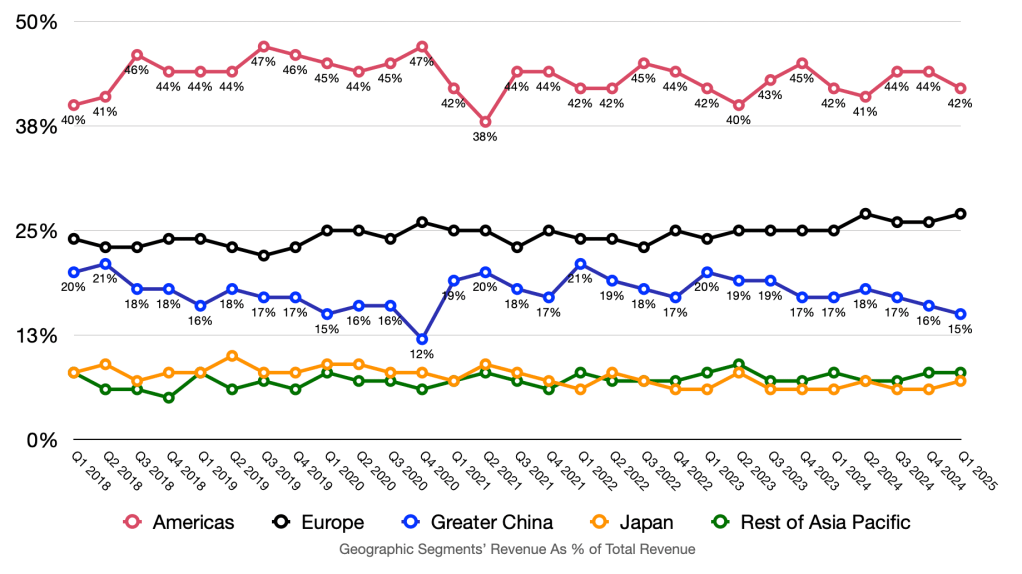

China

China declined by 11% this quarter. Apple said that the disappointing performance stemmed from the lack of Apple Intelligence in the market, unfavorable macroeconomics, the intense competition and its failure to stock up inventory properly to meet higher-than-expected demand. The last point is particularly interesting because it implied that Apple expected lower demand!

Taking into account the fierce competition, consumers’ preference for local brands and Apple’s reported numbers, I wonder if Apple’s peak in China is already in the past.

India can potentially supplement China. Apple repeatedly sounded optimistic about India and said that it decided to manufacture devices there because it believed there was enough demand. But right now, India is still an emerging small market. It will take time for it to grow. In the meantime, how can Apple maintain the revenue in China? Can it even?

As I mentioned multiple times before on this blog, Apple is in a strong position in the short term. However, there are concerns and uncertainty over the business over the long term. It’s hard to stay objectively optimistic because there is not a lot of time left for Tim and his executive team before they all retire. Without visibility into the next generation of leaders at Apple, how can we know that they can weather the storm like the current leaders have for so long?

Leave a comment