Key numbers vs Consensus:

- Revenue: $143.1 billion vs $141.4 billion

- Earnings Per Share (EPS): 85 cents vs 58 cents

- AWS Revenue: $23.1 billion vs $23.2 billion

- Advertising: $12.1 billion vs $11.6 billion

Amazon increased operating margin across the board, including North America, International and AWS. Whether it was layoffs or operational optimization, their efforts aimed at increasing efficiency clearly paid dividends. AWS’ margin, in particular, caught investors’ eyes, going up by 600 basis points sequentially, but the management cautioned that AWS margin would fluctuate in the future. This is the trickiness of looking at YoY comparison in isolation. The numbers could change for various reasons. Hence, it’s misleading to just focus on the numbers. Context matters. In the case of AWS, unless there is a prolonged period when the margin is outside of the historical range, there is no story.

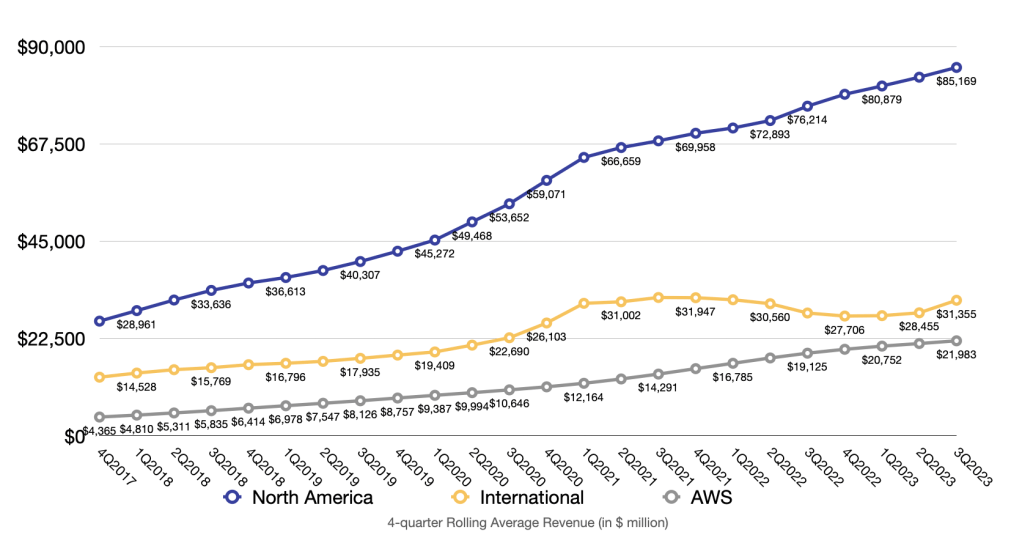

AWS now has an annual run-rate of around $88 billion. I expect in about 2-3 years, it will exceed $100 billion mark; which is a remarkable achievement for what was considered a “side hustle” in the begining. In terms of growth, AWS dipped below 15% for two consecutive quarters. One reason is the law of big numbers. The bigger the base, the harder it is to grow fast. But the bigger reason is that AWS clients have been cutting back usage and investments; which is not surprising when everybody strives to cut expenses. With that being said, I don’t expect companies to bring their infrastructure back on-premise or move to another cloud provider. A move like that is resource-intensive and in a time like this, not a priority.

Furthermore, the pandemic pulled forward a lot of International’s growth, leading to several quarters of revenue decline. However, the segment doesn’t lap the pandemic period anymore and returns to positive growth.

The two segments 3rd Party and (Ads + Others) continued to lead the way in terms of segment growth. Advertising is almost a $50bn-annual-run-rate business and because of high margin, it’s a great asset to the company. Physical Stores is now the smallest division and has the lowest growth. Moving forward, this is where I expect Physical Stores to be. There won’t be explosive growth for Wholefoods and the brick-and-mortar presence will be the test playground for future technologies.

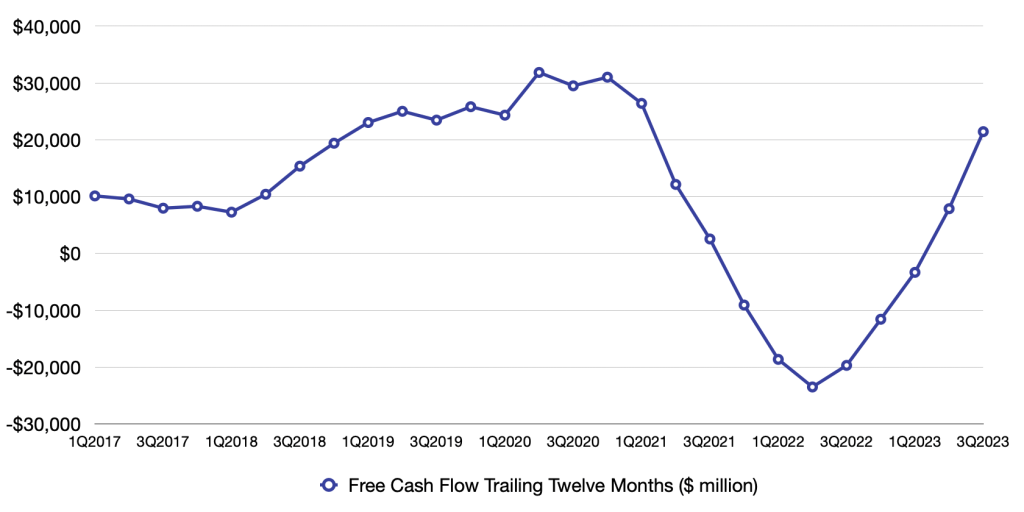

Free Cash Flow is roaring back after several quarters of steady decline. This signals that Amazon is already past the phase where they had to invest heavily in modernizing the fulfillment network.

Shipping costs continued to grow. It’d be useful to see what percentage shipping costs make of Gross Merchandise Value (GMV) that incurred theese costs. However, this seems impossible given how Amazon attributes revenue and expenses and what disclosures are available. Here is Amazon:

Shipping costs to receive products from our suppliers are included in our inventory and recognized as cost of sales upon sale of products to our customers. Shipping costs, which include sortation and delivery centers and transportation costs.

Fulfillment costs primarily consist of those costs incurred in operating and staffing our North America and International fulfillment centers, physical stores, and customer service centers and payment processing costs

Online Stores includes product sales and digital media content where we record revenue gross. We leverage our retail infrastructure to offer a wide selection ofconsumable and durable goods that includes media products available in both a physical and digital format, such as books, videos, games, music, and software. These product sales include digital products sold on a transactional basis. Digital media content subscriptions that provide unlimited viewing or usage rights are included in “Subscription services.”

Physical stores includes product sales where our customers physically select items in a store. Sales to customers who order goods online for delivery or pickup at our physical stores are included in “Online stores.”

Third-party seller services includes commissions and any related fulfillment and shipping fees, and other third-party seller services.

Nonetheless, if we base shipping costs against revenue from Online Stores and Third-party Seller Services, although the reference is not perfect, directionally speaking, sales seems to grow faster than the costs to ship. We can argue that Amazon is an ecosystem and the marketplace fuels other divisions like subscriptions or advertising. Hence, if we base shipping costs against ex-AWS revenue, we also see that revenue grows faster.

All in all, I think it’s a good quarter for Amazon. The numbers show that things are going in the right direction for the business, no matter how you look at it. Moving forward, I have confidence in Amazon for the following reasons:

- Consumer spending in America is truly a great wonder. We have been talking about recession, inflation and high interest rates for months, but only recently have we seen signs of some softness in spending from low-income households. As the biggest e-commerce player in the US and a trusted brand among shoppers, Amazon will continue to take up a sizeable share of consumer wallet.

- Last-mile delivery and fulfillment are HARD. Just ask Shopify how difficult because they abandoned their plan to compete with Amazon on this front. Amazon wasn’t complacent with the lead it built. Instead, it poured billions of dollars into upgrading its fulfillment network. Now, the gap between the retailer behemoth and its rivals seems to grow when it comes to delivering fast packages profitably. The faster delivery is, the happier shoppers will be. Simple, yet so difficult to implement.

- As long as Amazon has a firm grip on consumers, especially the Prime cohort, it will attract merchants who are willing to pay and advertise on Amazon to increase revenue.

- As mentioned above, I don’t expect a bumpy road for AWS in the near future. It may no longer grow at a neck-breaking pace, but it will steadily expand and contribute meaningfully to the company’s financials like it always has.

Leave a reply to Weekly reading – 4th November 2023 – Minh Quang Duong Cancel reply