Business

Microsoft 365 Copilot’s commercial failure. If the 2% adoption rate, despite billions of invested capital and constant claim on the life-changing power of AI, were true (I do not think it’s out of the realm of possibility at all), then we would have ourselves a bubble.

PepsiCo’s Plan to Boost Lay’s Sales: ‘Real Potatoes’. Consumers have started to be more health-conscious for a while. It’s not new that while they want to indulge in some snacks, they want healthier snacks that they feel good paying for. Pepsi just did not listen to what consumers were saying. Now, they switched strategies and started to go green and back to their roots. But as vegetable juices are tricky to handle and may shorten the shelf life, will the company innovate quickly enough to solve that problem or will it cave in and prioritize short-term profits again?

Intel’s Big Bet: Inside the Chipmaker’s Make-or-Break Factory. Intel cannot build a giant factory and leave most of it idle. Nor can the company sell chips at much higher prices than competitors’. This chicken-and-egg screams for one golden product that can draw in a major customer, even if Intel has to offer heavy discounts. The question is: can they deliver that golden product?

Beware the meteoric growth stories in the news. Some companies truthfully have a boombing business, others may just engage in some wizardry financial engineering. A story on WSJ discussed a company in Ohio that boast billions of dollars in annual revenue, only to disclose some horrifying truth about its own financial health in a bankruptcy filing. Many investors and tech observers are now concerned about AI companies engaging in vendor financing, a term that describes one investing in its own customers that, in turn, buy services/products of the investing company.

Americans can’t stop betting parlays. Sportbooks are cashing in. “As mobile sports betting booms, parlays are becoming more popular, accounting for an increasing share of the money wagered on sports. Sportsbooks are cashing in. Bettors lose billions of dollars a year on parlays, the data shows, and operators bring in far more revenue for every dollar wagered on these bets than they do straight bets. In most of the states that publish the relevant data, parlays account for between half and two-thirds of the operators’ revenue. The allure is part obvious, part insidious: Parlays up the stakes, and the potential bragging rights. They also stretch the entertainment of a wager across multiple games or turn otherwise inconsequential elements of a single game into decisive moments. And parlaysprovide the illusion of “almost winning” a bet rather than simply losing one.”

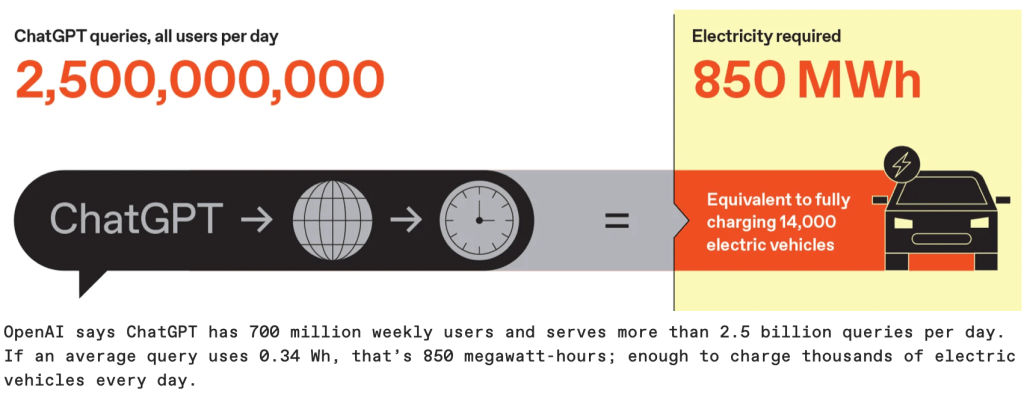

The AI capex endgame is approaching. “This followed the similar patterns from the introduction of nearly all general-purpose technologies — from railways, electricity, radio, semiconductors, to the internet. These bubbles didn’t end because the dream about the new technologies fell short; rather, the bubbles burst either due to regulation, increased competition, or the buyers of the products being unwilling, or unable, to sustain the demand. While the technology theme may be structural, all too often the end users are cyclical, putting the returns on investment in this excess capacity at risk from weakness in end-user cash flow.” See the post on the alleged low adoption rate of Microsoft 365 Copilot. Yes, OpenAI reported a lot of users and multiple billions of dollars in revenue, but such revenue pales in comparison to the Capex. That’s why it has huge losses and cannot stop raising funds. The question is: when will the reality check kick in?

Other Stuff I Find Interesting

How Germany outfitted half a million balconies with solar panels. It’s interesting to see how Germans outfit their balconies with solar panels. It’s not as interesting as how the country’s strategy on energy has turned out in the last two decades. It pushed a lot for renewable energy, only to do a 180 and rely on Russia for gas and oil, and then be alarmed about the reliance on the ever moody Russia.

Why Diamonds Are a Computer Chip’s New Best Friend. We are running up against the physical limits on how many transistors we can pack in a microscopic chip. Dealing with the heat generated in the process is another challenge, something that data centers have to solve as well. I’d never think that diamonds could be an answer to such problems. Fascinating.

Inside the Indonesian boomtowns powering the world’s electric vehicles. If you have an office job that allows you to work with a computer in an air-conditioned environment and earn a decent salary, be grateful. Out there, a lot of people risk their lives to make ends meet or to pay off debts because life gave them a bad hand. I felt bad reading about a Chinese worker who died working in a nickel mine because he had to find a way to pay off debts incurred by his mom’s surgery.

How China Secretly Pays Iran for Oil and Avoids U.S. Sanctions. “The arrangement, by sidestepping the international banking system, has provided a lifeline to Iran’s sanctions-squeezed economy. Up to $8.4 billion in oil payments flowed through the funding conduit last year to finance Chinese work on large infrastructure projects in Iran, according to some of the officials. In the arrangement, some of the officials said, an Iranian-controlled company registers the sale of oil to a Chinese buyer controlled by state-owned oil trader Zhuhai Zhenrong, a U.S. sanctions target. The Chinese buyer, in return, deposits hundreds of millions of dollars each month with Chuxin, officials said. Chuxin then delivers the funds to Chinese contractors that perform engineering work in Iran, in projects whose financing is insured by Sinosure. Sinosure serves as the financial glue that holds the projects together.”

Stats

Leave a comment